Iosub: National Bank's decision to reduce refinancing rate puzzling

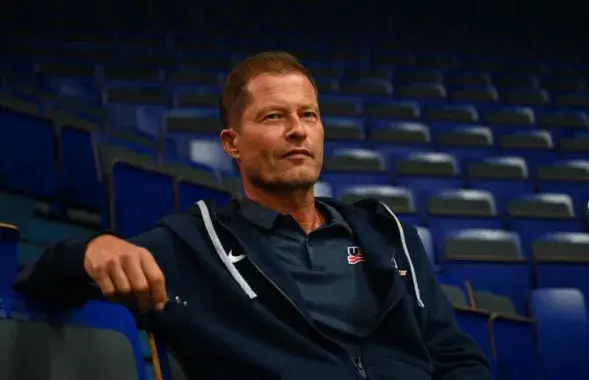

The National Bank has decided to reduce the refinancing rate from 24% to 22% starting from 1 May. The Senior analyst of "Alpari" Vadzim Iosub says that this solution looks quite strange.

"It looks strange because this resolution highlights a number of positive trends. In particular, it is the reduction of inflation and the normalization of the situation in the deposit market. However, it raises questions..." says the expert.

Iosub recalls that this year relatively low inflation in Belarus has been recorded only in March. A growing number of deposits was due more to the fact that after April 1, income from deposits began to be taxed, so majority of those willing to make a deposit did it in time for the introduction of the tax.

How will the new refinancing rate affect our lives? The expert said that after May 1, we should expect lower interest rates on deposits, which will be made after 1 May. "Banks will be forced to change the deposit rates by administrative methods... Banks will not benefit from new deposits at rates above 21.6%. In fact, it is very likely that this will be the new deposit borderline starting from 1 May." says Vadzim Iosub.

In addition, the National Bank's resolution states that starting from May interest rate on loans for legal entities should not exceed 27%.